The five subjects keeping execs awake at night

As we head towards a new year and start to plan our thought leadership programs for 2021, we have been taking a temperature check of the subjects most under discussion by C-level executives.

Blog

Robert Hollier

August 9, 2022

Read about the single most important insight from How Executive Buying Behavior & Preferences are Changing: Momentum ITSMA’s 2022 CBX Research [wave 1].

I was recently asked to identify the single most important insight from How Executive Buying Behavior and Preferences are Changing: Momentum ITSMA’s 2022 CBX Research [Wave 1].

Kind of like asking which child is the favorite.

Okay, not quite. However, there was one piece of data that stood out above the rest because it could have far-reaching implications for our members and customers – if they pay attention.

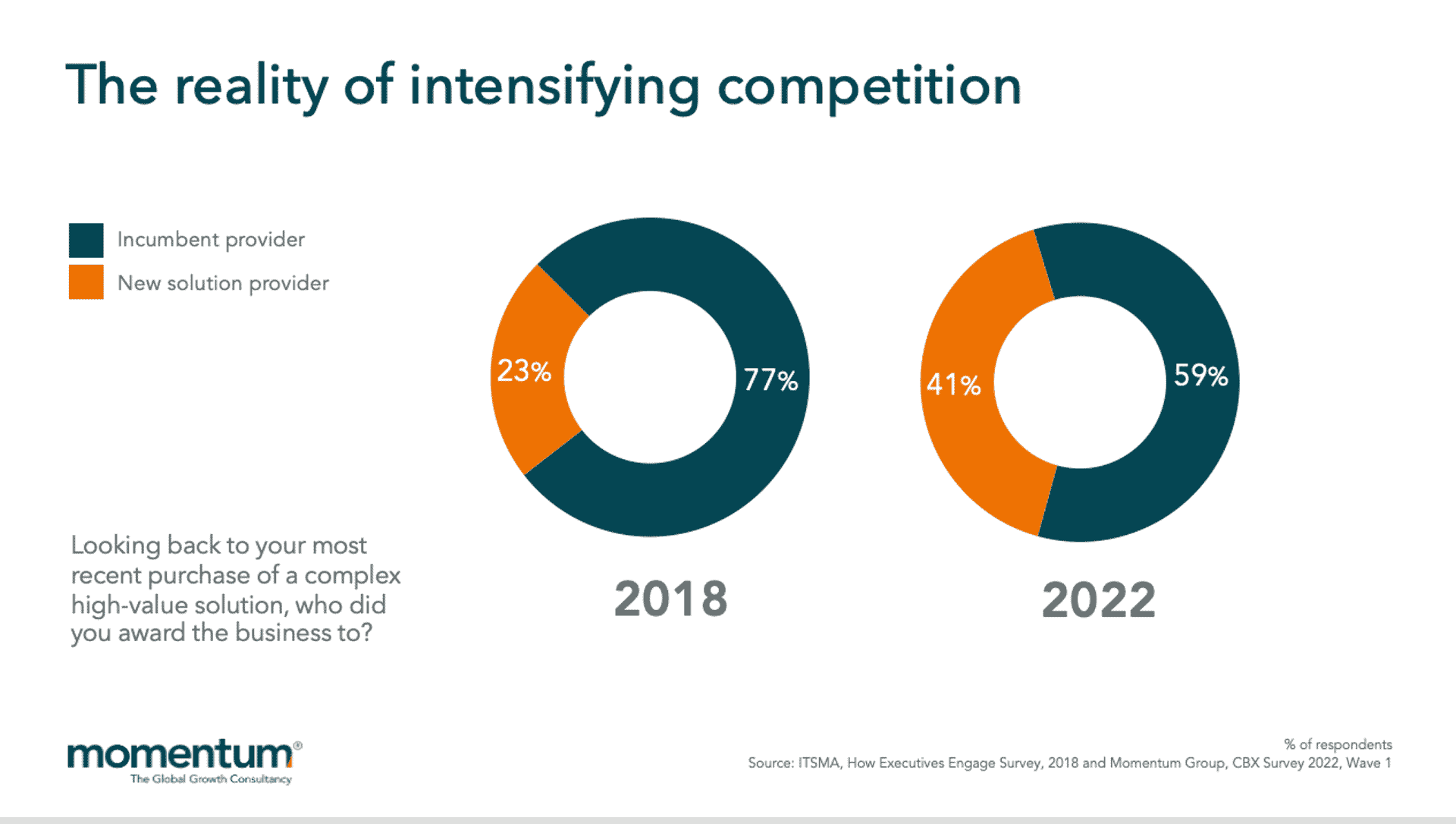

We asked senior IT and business decision makers / influencers about their most recent purchase of a complex, high value solution.* We wanted to know who won the business. Nearly 2/3 (59%) of the respondents indicated that they awarded the bid to the incumbent.

But that’s just the beginning of the story. A mere four years ago, in 2018, more than ¾ of the time (77%), the incumbent would win.

This is a fairly dramatic shift in loyalty. Large enterprise accounts may no longer be giving incumbent solution providers the benefit of the doubt. Instead, they are much more open to new providers and significantly less likely to default to the incumbent.

This has important implications for all solutions providers, whether you’re looking at establishing or deepening relationships with a company.

First, if you are the incumbent, you cannot rest on your laurels. You need to know there’s serious competition out there and you may need to need to work twice as hard to retain and grow existing accounts.

On the flip side, this means there may be some great opportunities to win new accounts. Again, you have to work hard and prove your worth – but, at least now, your targets are willing to listen.

While we did not survey buyers about why they chose either the new or incumbent solution provider, subsequent conversations with clients have shed some light on the shift.

First, buyers may be focusing on new types of solutions and the incumbent may not have the capabilities to deliver.

Another insight is that buyers are often spending differently on different types of solutions given all the disruption of recent years coupled with the business’s “innovation imperative” Sometimes this means they’re required to look beyond incumbents, even if they are relatively satisfied with them.

What can solution providers do?

If you are the incumbent, you need to re-assess the strategies you have in place to protect and grow your existing accounts. Your focus should be on doubling down on your installed base. You may need to look at new solution innovation while also focusing on marketing and sales.

If you’re chasing new logos, then you might need to re-calibrate your strategies to capitalize on new opportunities. Your marketing and sales need to be targeted and relevant.

B2B marketers can seize this opportunity by:

As financial organizations say, past performance is not indicative of future results. The same can now be said for large, enterprise purchases. Competition is intensifying and it’s imperative that solution providers have differentiated strategies in place to support account-based growth goals.

The How Executive Buying Behavior and Preferences are Changing: Momentum’s 2022 CBX Research [Wave 1] report is available at no charge for Momentum ITSMA Growth Hub members. To inquire about becoming a member, please contact luisa.jones@momentumitsma.com.

*Note: We asked about recent actual purchase decisions and investments, not purchase intentions. We’re also talking about the world’s largest enterprises – respondents were senior IT and business decision makers and influencers responsible for purchases greater than $500M in the US and Canada or $250M in EU and Asia.

As we head towards a new year and start to plan our thought leadership programs for 2021, we have been taking a temperature check of the subjects most under discussion by C-level executives.

Blog

Dowshan Humzah, Independent Board Director and Transformation Specialist, joins us on the ABM Podcast as a part of the Momentum ITSMA CBX™ series.

Podcast

Tony Miller former Marketing VP at Disney and Marketing Director at WW joins us on the ABM Podcast as a part of the Momentum ITSMA CBX series.

Podcast